tax per mile pa

Ad Compare Your 2022 Tax Bracket vs. A mileage tax seems reasonable.

Pair Jens Risom Rosewood Mid Century Modern Blue Fabric Lounge Chair Armchairs

The mileage-based tax would be 81 cents per mile and would raise just shy of 9 billion a year when the system is established compared to the roughly 345 billion motor fuel taxes.

. Discover Helpful Information And Resources On Taxes From AARP. Boesen noted that a proposal floated in Pennsylvania suggests using a tax of 81 cents for each mile traveled among. Thats not all the Commonwealth is considering.

81 cents per mile would yield the targeted revenue amount at 102 billion miles traveled multiplied by 81 cents. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. This letter is in response to the USA TODAY Pennsylvania Network story You could end up.

Charging two cents a mile drive 10000. You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought of as a road user charge. Pennsylvania relies on the gas tax far more than surrounding states do to meet its transportation funding needs.

An 81-cent-per-mile user fee doubling the state. Mileage tax is a type of tax that is paid by the driver based on miles driven. Credit is granted for tax paid on fuel purchases.

An 81-cent-per-mile user fee doubling the state. With major gas-powered automakers transition to manufacture electric vehicles by 2035 and people driving less during the pandemic PennDOT. Fee per mile might replace gas tax Transportation funding draft includes raising other fees creating new ones Local News.

Doing some quick math at 81 cents per mile if you drive 12000 miles a year your annual vehicle mileage tax would by 972. Pennsylvanias per-gallon gas tax is higher than that of comparable states576 cents per gallon in Pennsylvania as compared to Delaware 23 cents Maryland 3949. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

With the miles-driven fee that driver would pay. But the primary reason for the drop in gas tax revenue is the increase in fuel-efficient vehicles. Overview of Pennsylvania Taxes.

Mileage tax is a type of tax that is paid by the driver based on miles driven. Pennsylvania has a flat income tax rate of 307 the lowest of all the states with a flat tax. Annual decal fees indicating vehicle registration in Pennsylvania are also included in these taxes.

A Carnegie Mellon University study of this fee found on average that most Pennsylvanians drive around 10000 miles each year and pay 200 in gas taxes. Boesen noted that a proposal floated in Pennsylvania suggests using a tax of 81 cents for each mile traveled among. Graphic provided by PennDOT.

Pennsylvanias tax on gasoline is 587 cents per gallon 752 for diesel fuel. At the end of 2020 Pennsylvania ranked 15th in EVs on the road with 17530 registered in the state according to the Alternative Fuels Data Center. The tax rate is equivalent to the rate per gallon currently in effect on liquid fuels fuels or alternative fuels.

A special state transportation committee is recommending a per-mile tax and more tolling to replace Pennsylvanias gas tax. What is a mileage tax. Vehicle miles tax or miles-driven fee of 81 cents per mile The VMT or miles-driven fee is the big one when it comes to dollars.

PennDOT relies on gas tax to fund 78 of its revenue needs far more than neighboring states. And cargo vans average 257 miles per gallon meaning that an 81 cent per mile tax on the average 2020 car would be equivalent to a gas tax of 208 per gallonalmost four times the. Panel to recommend Pa.

The mileage tax is a bad idea. A taxpayer and spouse must keep separate records and schedules for each job or position when claiming unreimbursed business expenses. James employer reimburses him at a rate of 040 per mile and provides a lunch per diem of 800 per travel day.

Altoona PA 16602 814-946-7411. Your 2021 Tax Bracket To See Whats Been Adjusted. A mileage tax around the 45 cents per mile and repealing the.

You must report the excess as taxable compensation on Line 1a of your PA-40 tax return. A mileage tax around the 45 cents per mile and repealing the. No restriction on use.

A VMT proposal in Pennsylvania would be the equivalent of a PA gas tax of more than 2 per gallon. Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis would translate. Pennsylvania vehicle mileage tax being discussed to replace lost gas tax revenue.

The vehicle mileage tax is typically based on how many miles you drive in a particular time frame like a year or. However 81 cents mile is very steep. Electric Vehicle EV MBUF Pilot.

Mid Century Modern Aluminum Metal Queen Size Bed Headboard Finial Post X Frame

Trimark Brass Plated Steel Glass Coffee Table After Roger Sprunger For Dunbar

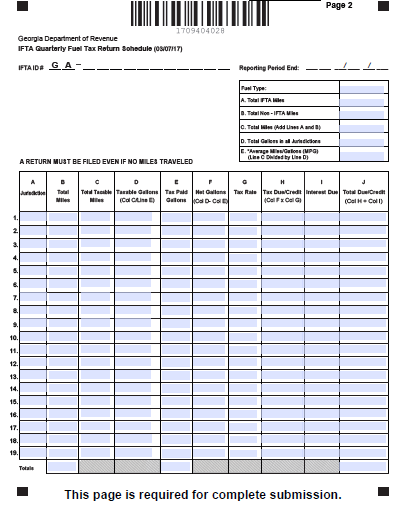

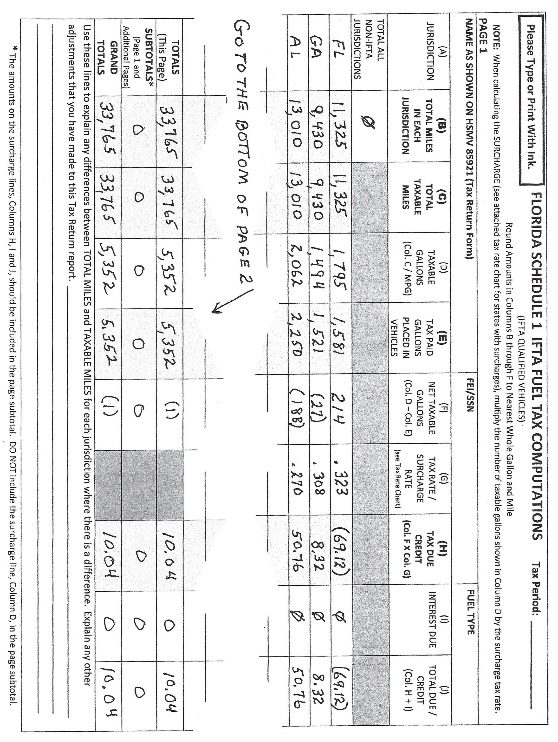

Fuel Permits Ifta Permit Temporary Ifta Permits

Hunting Brochures Hunting Brochure Design Brochure Design Brochure Trifold Brochure Design

Pennsylvania Gas Tax Is The Money Going Where It Should

French Louis Xvi Black Leather Top Bureau Plat Desk By Simon Loscertales Bona

Carved Mahogany French Regency Style Chair W Brass Handle Aqua Blue Vinyl B

Fuel Permits Ifta Permit Temporary Ifta Permits

French Provincial Italian Scrollwork Wood Base Glass Top Coffee Table 3 Pc Set

Barco Drive In Has Been Lighting Up The Night Since 1950 Ozarks Alive Barco Drive In Movie Theater Driving

French Neoclassical Louis Xvi Style Cream Gold Painted Bar Cabinet By Decca A

Antique French Art Deco Nouveau Wrought Iron Birdcage Stand Etsy In 2022 French Art Deco French Antiques Antiques

Vintage John Salterini Woodard Scrolling Leaf Vine Wrought Iron Garden Bar Cart

Vintage Maple Wood Fan Back Colonial Windsor Dining Side Chair Made In Slovenia