travel nurse state taxes

This means youll pay extra self-employment taxes since your employer isnt paying any of your taxes but you also get extra deductions. This means theyll have to calculate and remit all taxes to the IRS and state authorities.

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

The expense of maintaining your tax home.

. You may be subject to state income tax in both the state of your permanent residence and the states where you had travel nurse jobs. 2021 has been a unique year for travel nurses and some pay packages were different from traditional travel. 20 per hour taxable base rate that is reported to the IRS.

Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient when it comes to requesting extensions. Any phone Internet and computer-related expensesincluding warranties as well as apps and other. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable.

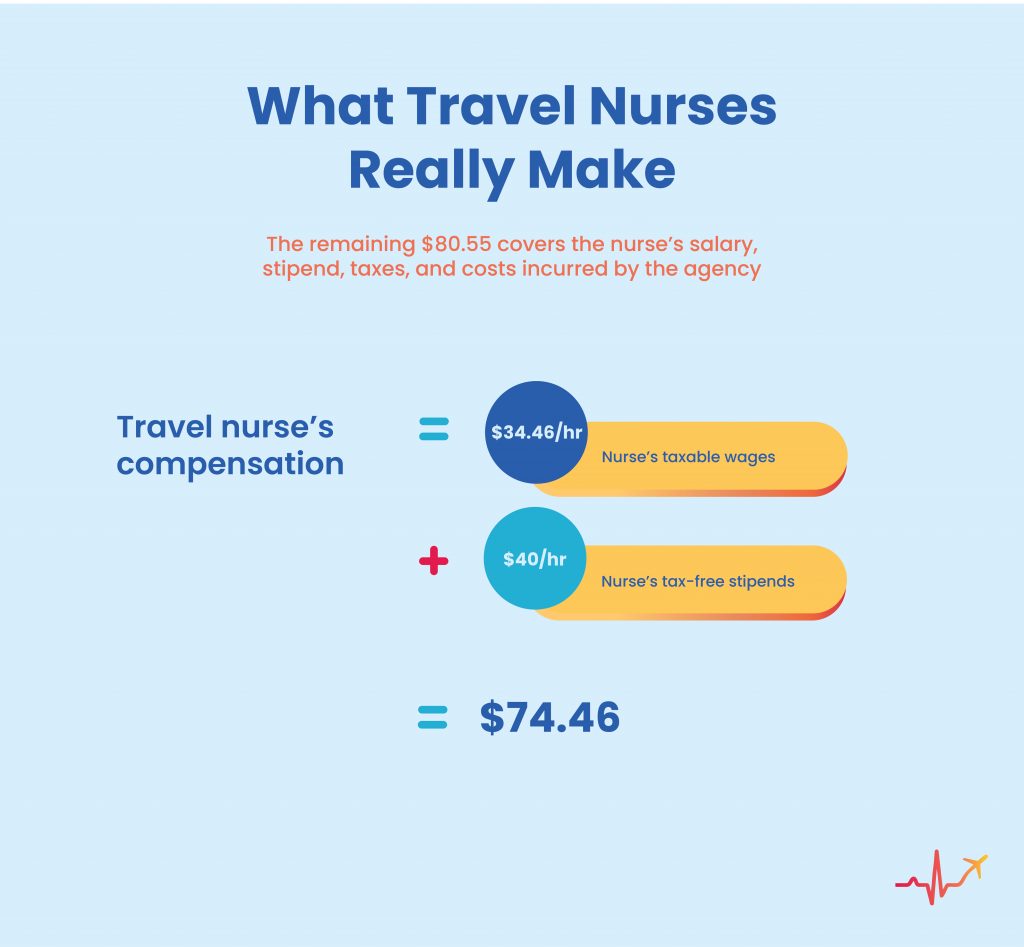

For Sample 1 were looking at 720 16759 55241 68846 124087 net weekly pay. Here is an example of a typical pay package. These stipends and reimbursements are for expenses such as meals parking transportation fees and housing.

You will owe both state where applicable and federal taxes like everyone else. This is typically done in the form of an expense report. States have a state income tax but Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming dont.

A 1099 travel nurse handles all their documentation and taxes themselves. This is the most common Tax Questions of Travel Nurses we receive all year. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly.

But it is pretty close. Reimbursements are business-related expenses that you have paid for out-of-pocket that your employer pays you back for. Travel Nurse Tax Deduction 1.

And how this distinction is the main source of confusion among travelers recruiters and staffing agencies who try to determine whether travel reimbursements. In this case it is 25720 before taxes or 5495hour. This is how a lot of travel nurses handle taxes.

There are a handful of important tax advantages to be aware of as a travel nurse primarily in the form of stipends and reimbursements. The fact that the income was not earned in the home state is irrelevant. 1 A tax home is your main area not state of work.

Typically there are stipends or reimbursements for travel nurses. As mentioned above we simply subtract the estimated weekly taxes from the weekly taxable wage and add the remainder to the total weekly tax-free stipends to calculate weekly net pay for a contract. 250 per week for meals and incidentals non-taxable.

Instead of looking at the primary place of incomebusiness it allows the tax home to default fall back on the permanent residence. Then add taxed and untaxed. For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals.

Travel nurse income has a tax advantage. In previous articles I have pointed out the difference between a permanent residence and a tax residence. I could spend a long time on this but here is the 3-sentence definition.

But I Didnt Work Thereand similar comments about travel nurse taxes and state tax returns. Tax break 3 Professional expenses. For example if you live in Arizona and take a nursing job in Oregon that lasts for several months your tax home might end up being Oregon rather than.

Simply put your tax home is the state where you earn most of your nursing income. As a travel nurse you have a unique career experience traveling across the country providing care to patients in needNurses love the freedom flexibility and adventure of becoming a traveling nurse. You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable.

If you use the right software to track your money and file your taxes you can easily handle your taxes on your own. For true travelers as defined above the tax rules allow an exception to the tax home definition. Basically only income earned in California is taxed there.

Two basic principles are at work here. Travel expenses from your tax home to your work. First your home state will tax all income earned everywhere regardless of source.

This illustrates that the total value of the contract with taxed and untaxed income. File residence tax returns in your home state. However this can also make your taxes tricky.

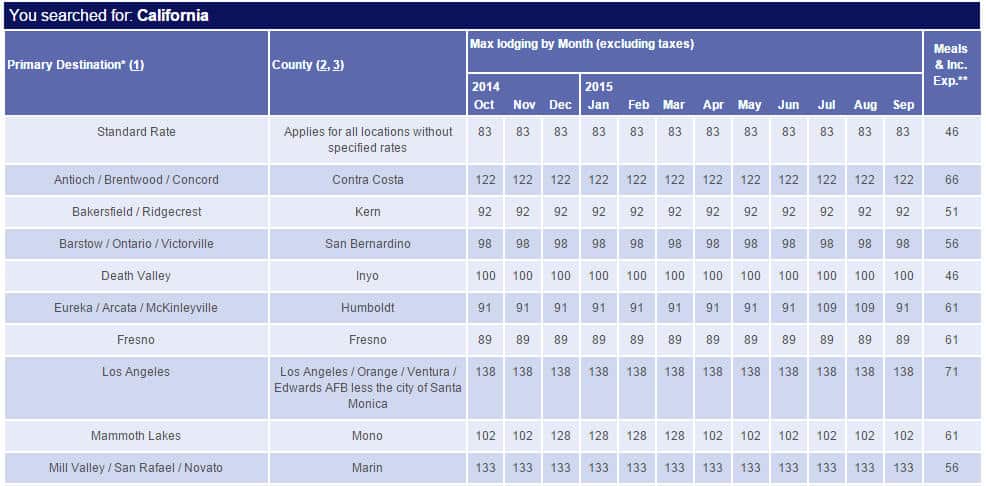

But many states including California use a percentage based approach to figuring out taxes due plus different personal exemptions so it may not be exact per my first sentence. 2000 a month for lodging non-taxable. For general questions and answers on salary and open positions complete the form for a quick question call 800-884-8788 or apply online today.

Travel nurses pay taxes as independent contractors. The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. At the same time the work state will.

One of the primary terms you will hear when filing your taxes as a traveling nurse is tax home. The costs of your uniforms including dry cleaning and laundry costs. This makes it very easy to compare two contracts total value.

State travel tax for Travel Nurses. Deciphering the travel nursing pay structure can be complicated. In California Tax-Free Stipends can be as much as 1800 per week for housing in San Francisco and 500 per week for Meals and.

Know about State Income Tax. Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes. For W2 employees FICA tax of 153 of gross earnings is deducted from their paycheck to fund social security and medicare and their employer pays for half of the tax.

Companies can reimburse you for certain expenses while working away from your tax home. Tax day is April 18 2022 and you might be wondering about filing taxes as a travel nurseWere not tax pros and we recommend talking. Tax deductions for travel nurses also include all expenses that are required for your job.

For this to apply however the travel nurse must meet 2 out of 3 of the following criteria. Tax-Free Stipends for Housing Meals Incidentals. If you need more time feel free to ask for it.

Here are some categories of travel nurse tax deductions to be aware of. 500 for travel reimbursement non-taxable. Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other.

Not just at tax time.

Trusted Event Travel Nurse Taxes 101 Youtube

Travel Nurse Insight What Goes In To Pay Packages

Taxes And The Travel Nurse Travel Nursing Travel Nurse Quotes Travel Nursing Agencies

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Travel Nurse Tax Pro Home Facebook

Trusted Guide To Travel Nurse Taxes Trusted Health

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How To Make The Most Money As A Travel Nurse

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

6 Things Travel Nurses Should Know About Gsa Rates

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Talking Travel Nurse Taxes The 50 Mile Rule The Gypsy Nurse

All You Need To Know About Travel Nursing In The Us Infographic Travel Nursing Nursing Infographic Nursing Programs

Travel Tax The Travel Nurse S Guide To Taxes Travel Nursing

Your Travel Nurse Tax Guide Premier Medical Staffing Services

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing